When you are in the process of starting up a business for the first time, it is possible that you might have never heard about the importance of surety bonds. But these bonds are absolutely essential for every businessman who wants to establish a successful business. In fact, they play a vital role in ensuring that you get paid the amount that you have earned. Without surety bonds, a lot of things can go wrong. For example, if you were selling your products without them, you would end up getting rejected. The reason for this is that the customer might not be satisfied with the product that you have offered and thus will not buy from you.

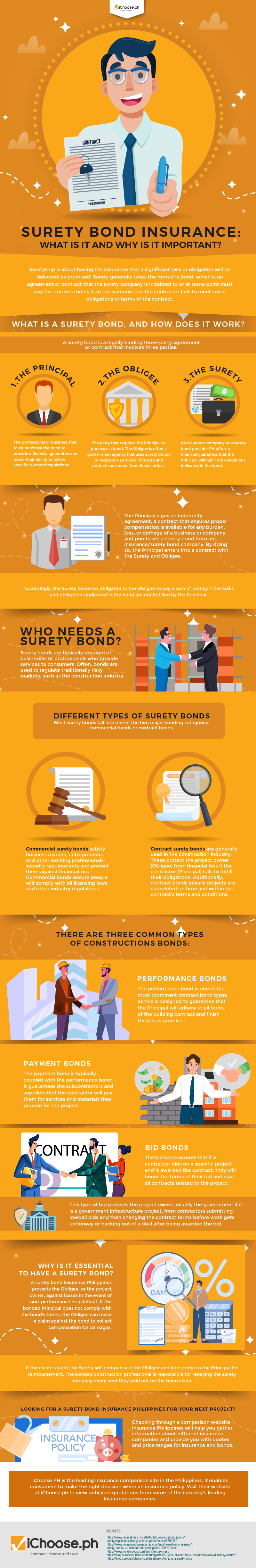

Here is how surety bonding works. A person becomes a surety for you by signing an agreement that he or she will pay the principal amount if the principal is not paid in time. This is known as the bond. The reason why there is a bonding involved is because the principal and the money are irreplaceable.

Another important thing that you need to know about commercial surety bonds is that they are different from license bonds. License bonds are required when a person has to get special permits such as a building permit. On the other hand, commercial surety bonds are required when a person wants to open a business. The main difference between the two is that when you get a license, you can operate the business without having to worry about getting a bond. However, when you get commercial surety bonds, you will have to get one in order to start the business.

Another thing that you should know about surety bonds is that they differ from insurance and liability insurance in a lot of ways. For instance, insurance is necessary for casualty only. On the other hand, surety bonds are required for all manner of business activities.

For surety bond insurance philippines or surety bond provider ph, contact iChoose.